monterey county property tax rate 2021

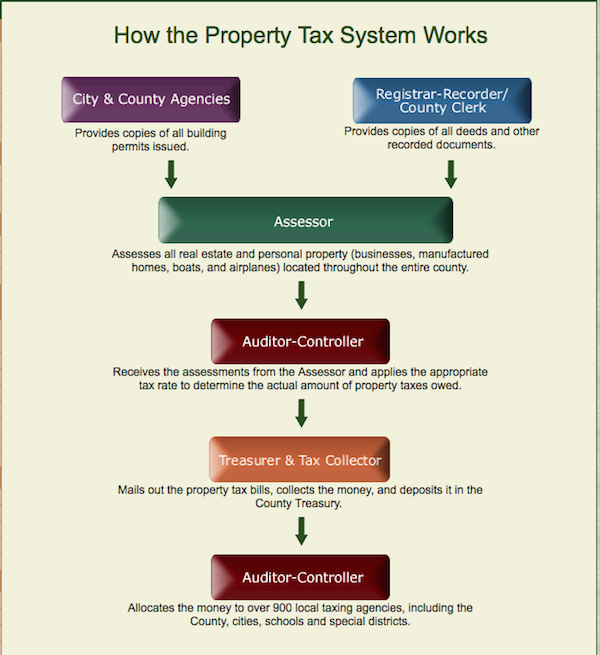

2022 Property Statement E-Filing E-Filing Process. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established.

The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Choose Option 3 to pay taxes. 2021 2021 2021 000 000 000 payments 831 755-5057 000 addr chgs 831 755-5035 valuations 831 755-5035 12000 exemptions 831 755-5035 tax rates 831 755-5040 000.

The California state sales tax rate is currently 6. Note that 1095 is an effective tax rate. Monterey County Property Tax Due Dates 2021.

Easily run a rapid Monterey County CA property tax search. The minimum combined 2022 sales tax rate for Monterey County California is 775. Normally whole-year property taxes are paid upfront a year in advance.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. 368799 2021 Property Taxes. Agency Direct Charges Special Assessments.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales. You will need your 12-digit ASMT number found on your tax bill to make payments. The median property tax in Maryland is 277400 per year for a home worth the median value of.

Monterey County collects on average 051 of a propertys. As computed a composite tax rate. The transfer tax is levied on a portion of the assessed value of a property that exceeds the countys property tax rate.

Just type in the exact address in the search bar below and instantly know the targeted propertys bill for the latest tax year. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. Then who pays property taxes at closing when buying a house in Monterey County.

Testing Locations and Information. As a result if your home is valued at 1000000 and the county tax. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of.

This is the total of state and county sales tax rates. Where do Property Taxes Go. Monterey county collects relatively high property taxes and is ranked in the top half of all counties in the united states by property.

Fiscal Year 2022-2023 Direct ChargeSpecial Assessment. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent. Real estate ownership shifts from.

For all due dates if the date falls on a saturday sunday or county holiday the due date is extended to the following business. Unsecured taxes are made up of approximately 21000 assessments that contribute 32000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts within. Download all California sales tax rates by zip code.

Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in. Fort Ord 583802690 13403466 597206156 TOTAL 7005105261 706782311 7711887572 202122 Monterey County Tax Rates - 2 - Values By Taxing Agency. November 1 2021 to all property owners.

Median Home Price Hits 887 500 In Monterey County As Inventory Stays Low Monterey Herald

Monterey County Fire Relief Fund Community Foundation For Monterey County

Monterey County Median Home Price At 885 500 In February Up 9 From Last Year Monterey Herald

Treasurer Tax Collector Monterey County Ca

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Los Angeles Property Tax Which Cities Pay The Least And The Most

Property Taxes Department Of Tax And Collections County Of Santa Clara

2020 Residential Property Tax Rates For 344 Ma Communities Boston Ma Patch

Riverside County Ca Property Tax Search And Records Propertyshark

Orange County Ca Property Tax Calculator Smartasset

Monterey County Weekly Editorial Board S Endorsements In Local Regional Statewide And National Elections Cover Montereycountyweekly Com

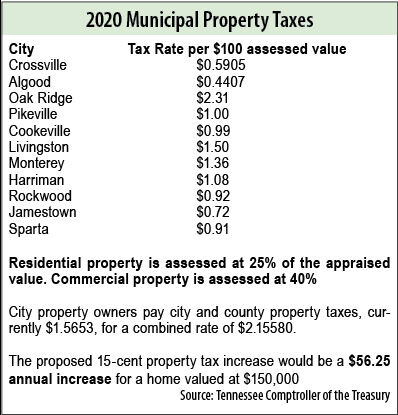

15 Cent Property Tax Increase Ok D Local News Crossville Chronicle Com

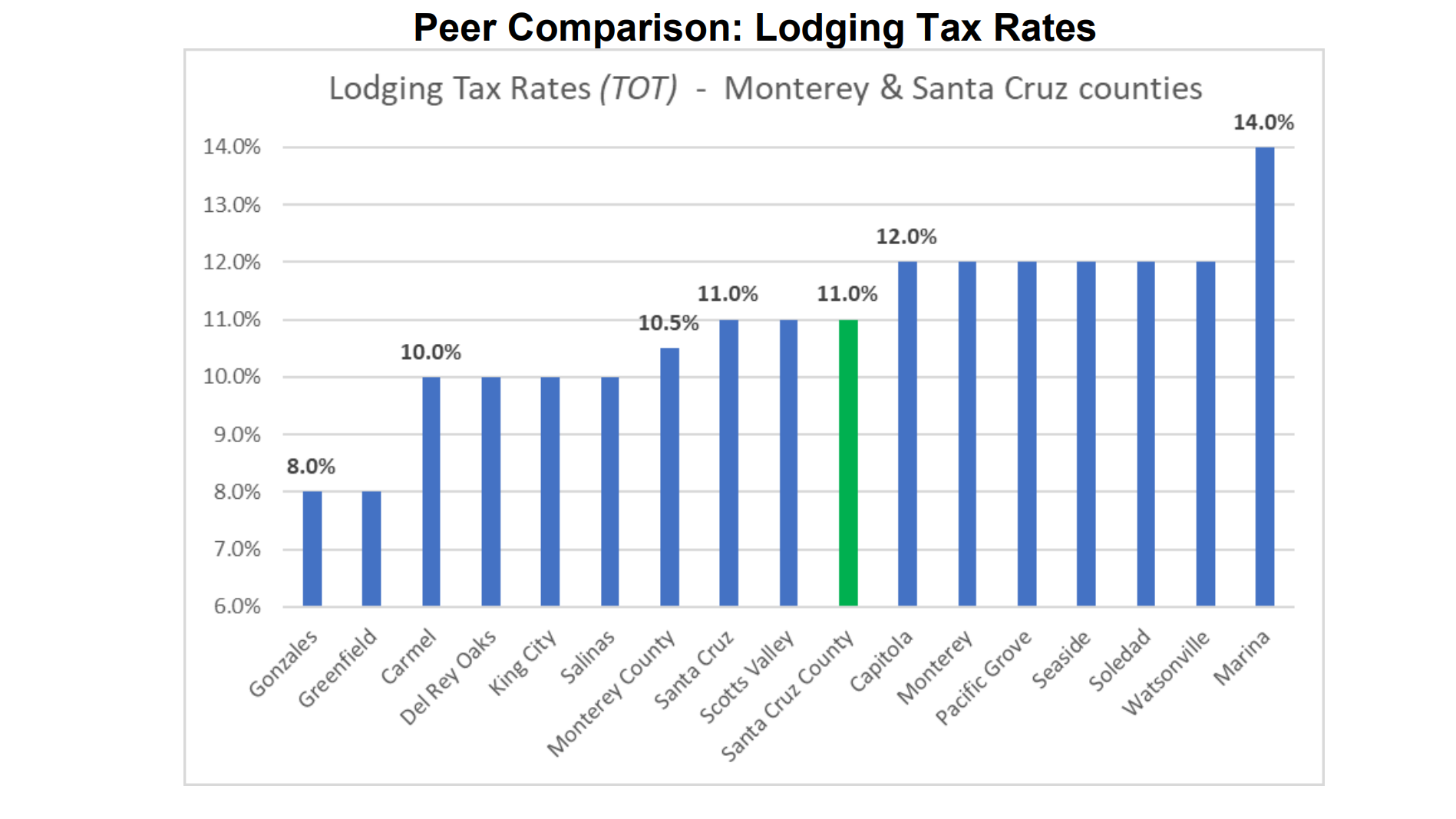

Election Guide Measure B In Santa Cruz County Santa Cruz Local

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

Yuba County Ca Property Tax Search And Records Propertyshark

Shasta County Ca Property Tax Search And Records Propertyshark

Prop 218 Benefit Assessment North County Fire Protection District